WELCOME TO BURNABY NEIGHBOURHOOD HOUSE

20th Annual Fundraiser Gala

Join us for a night of glamour and fundraising at this milestone Gala year on Saturday, March 15th at the Delta Hotels Burnaby. Highlights include: buffet dinner, silent and live auction, entertainment by Frank Sinatra impersonator, Ronnie Scott. Reserve your spot now!

ALL BNH Child Care Centres and Houses are open and resume normal business hours on Friday, January 19, 2024.

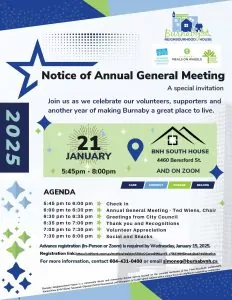

NOTICE OF ANNUAL GENERAL MEETING 2025

To see the AGM poster in full – click here

We welcome all members to attend the BNH AGM on Tuesday, January 21st – 5:45 pm to 8:00 pm.

Advance registration (In Person or Zoom) is required by Wednesday, January 15, 2025.

For registration link – please click here.

For more information, contact 604-431-0400 or email simoneg@burnabynh.ca

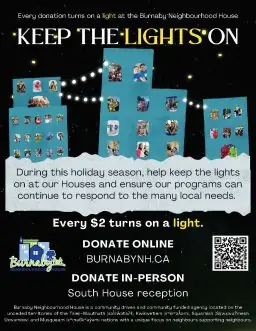

KEEP THE LIGHTS ON

Each year we look to the community to help us keep the lights on in our neighbourhood houses which in turn allows us to keep programs running throughout the year.

From tai chi and yoga, to settlement services, the food banks and senior and family programming and everything in between, your donations will help us continue to meet the diverse needs of the community.

Use the QR code or click the button below to donate!

Burnaby Neighbourhood House is a community driven and community funded agency located on the unceded territories of the Tsleil-Wauthuth (səl̓ilw̓ətaʔɬ), Kwikwetlem (kʷikʷəƛ̓əm), Squamish (Sḵwx̱wú7mesh Úxwumixw) and Musqueam (xʷməθkʷəy̓əm) nations with a unique focus on neighbours supporting neighbours.

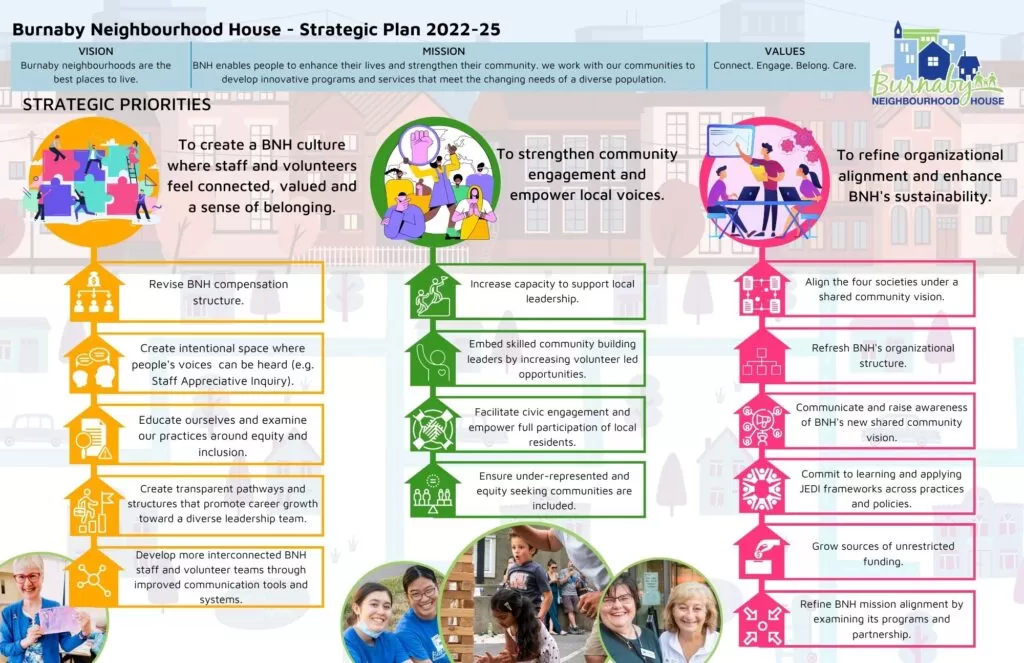

Strategic Plan 2022-2025

Who We Are

Vision

Burnaby neighbourhoods are the best places to live.

Mission

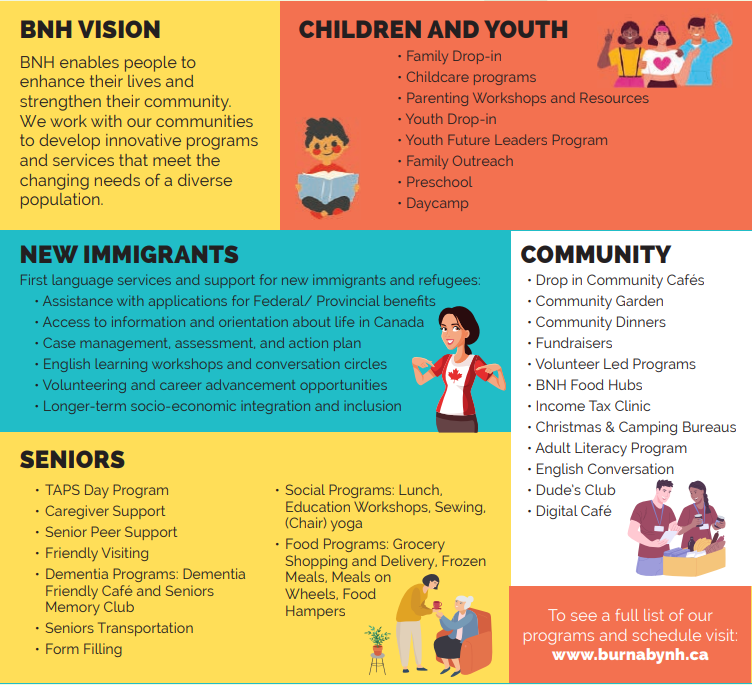

BNH enables people to enhance their lives and strengthen their community. We work with our communities to develop innovative programs and services that meet the changing needs of a diverse population.

Values

Care. Connect. Engage. Belong.

A Community-Based Project with the City of Burnaby

EXCITING ANNOUNCEMENT

Burnaby Neighbourhood House is pleased to announce that we are the new umbrella organization for Burnaby Community Services, Burnaby Meals on Wheels and Burnaby Seniors Outreach Society. Antonia Beck has been appointed the CEO of all the societies, including BNH.

Our societies have a long-standing working relationship and are now coming fully together to better serve the residents of Burnaby, share resources, strengthen our programs and better integrate our services to address the growing needs in our community.

Burnaby Neighbourhood House board and staff are committed to keeping all current programs and services of the societies operating and look forward to maintaining the financial support from funders and donors to ensure sustainability and success in the years to come.

For more information on this announcement please contact Antonia Beck at (604) 431-0400, AntoniaB@burnabynh.ca

For more information on the many programs that we will continue to offer check out the respective websites.

WHAT'S HAPPENING

Farmer’s Market Nutrition Coupon Program (FMNCP)

Deadline: July 4, 2025 at 3:30PM

The Farmers’ Market Program targets low-income pregnant women, low-income seniors, and low-income families with children aged 18 or under. The application deadline for the program is July 4, 2025 at 3:30pm. To apply, please submit your name and complete the pre-screening questions at any Burnaby Neighbourhood House location to determine your eligibility.

Langara College Recreation Research in the City of Burnaby

🧡Your voice matters!

BNH Summer Social 2025

Date: July 24, 2025 | Time: 5:00 PM – 8:00 PM

📍 4460 Beresford St.

Date: August 14, 2025 | Time: 4:30 PM – 7:30 PM

📍 2055 Rosser Ave.

🔥 Hot dogs to snack on 🌭

🎤 Live entertainment to vibe to 🎶

🤸♀️ Fun activities for all ages!

BNH Summer Social 2025

Date: July 24, 2025 | Time: 5:00 PM – 8:00 PM

📍 4460 Beresford St.

Date: August 14, 2025 | Time: 4:30 PM – 7:30 PM

📍 2055 Rosser Ave.

🔥 Hot dogs to snack on 🌭

🎤 Live entertainment to vibe to 🎶

🤸♀️ Fun activities for all ages!

Langara College Recreation Research in the City of Burnaby

🧡Your voice matters!

BURNABY CHRISTMAS BUREAU 2024

The BURNABY CHRISTMAS BUREAU provides Christmas cheer to people with low income and living in Burnaby through

our Toy Room and Seniors Hamper Program. This continues to be challenging times for many people, and we are

anticipating great need again for families with children, and seniors with low income.

BURNABY CHRISTMAS BUREAU 2024

The BURNABY CHRISTMAS BUREAU provides Christmas cheer to people with low income and living in Burnaby through our Toy Room and Seniors Hamper Program. This continues to be challenging times for many people, and we are anticipating great need again for families with children, and seniors with low income.

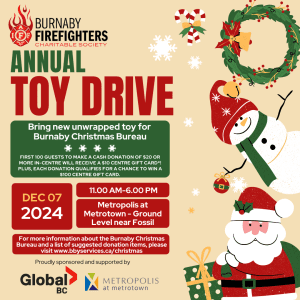

BURNABY FIREFIGHTERS TOY DRIVE

The Burnaby Firefighters Charitable Society will be holding their Annual Toy Drive, an event that aims to brighten the holiday season for children and families in need. We are calling on the community to participate by bringing a new, unwrapped toy or a cash donation. The drop off location will be at Metropolis at Metrotown on December 7, 2024 from 11 AM to 6 PM.

CONTACT US!

BNH South House | South Burnaby

#100 – 4460 Beresford St, Burnaby, BC V5H 0B8

Monday – Friday | 9:00am – 5:00pm

Phone: (604) 431-0400

Email: info@burnabynh.ca

BNH North House | North Burnaby

4908 Hastings St, Burnaby, BC V5B 1P6

Monday – Friday | 9:30am – 4:30pm

Phone: (604) 294-5444

Email: northinfo@burnabynh.ca

BNH Brentwood House | North Burnaby

2055 Rosser Ave, Burnaby, BC V5C 0H1

Monday – Friday | 9:00am – 4:00pm

Phone: (604) 299-5778 | (604) 299-5754

Email: info@bbyservices.ca | info@burnabymeals.ca