Due to the high volume of the applications, it will take 7-10 business days for our staff to get back to you. If you cannot wait for the appointment, please look for another income tax clinic: https://apps.cra-arc.gc.ca/ebci/oecv/external/prot/cli_srch_01_ld.action

The BNH Income Tax Clinic is now closed for the year. We look forward to seeing you next year!

To find other volunteer Income Tax Clinics, please click here.

If you need help with translation, please refer to the translated version below and fill out the screening pre-form by clicking the link above.

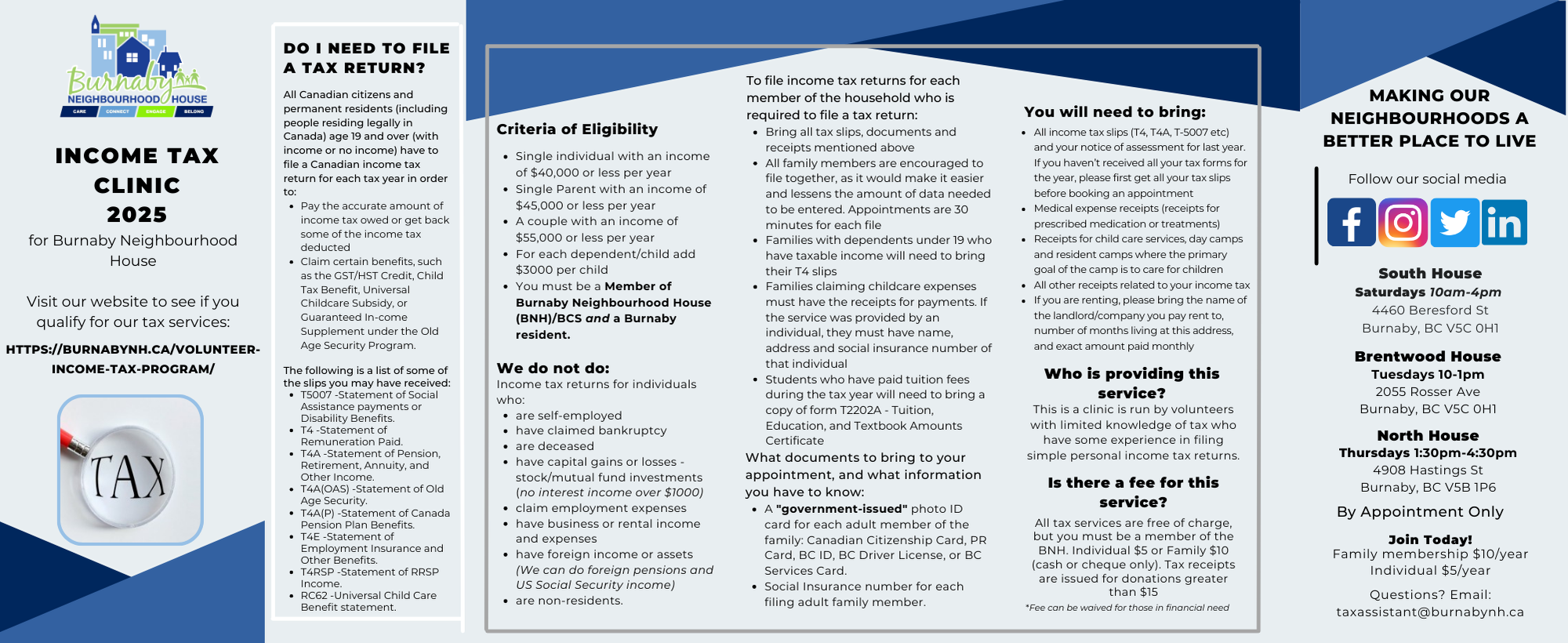

All Canadian citizens and permanent residents (including people residing legally in Canada) age 19 and over (with income or no income) have to file a Canadian income tax return for each tax year in order to:

- Pay the accurate amount of income tax owed or get back some of the income tax deducted

- Claim certain benefits, such as the GST/HST Credit, Child Tax Benefit, Universal Childcare Subsidy, or Guaranteed In-come Supplement under the Old Age Security Program

- T5007 -Statement of Social Assistance payments or Disability Benefits

- T4 -Statement of Remuneration Paid

- T4A -Statement of Pension, Retirement, Annuity, and Other Income

- T4A(OAS) -Statement of Old Age Security

- T4A(P) -Statement of Canada Pension Plan Benefits

- T4E -Statement of Employment Insurance and Other Benefits

- T4RSP -Statement of RRSP Income

- RC62 -Universal Child Care Benefit statement

- Single individual with an income of $40,000 or less per year

- Single Parent with an income of $45,000 or less per year

- A couple with an income of $55,000 or less per year

- For each dependent/child add $3000 per child

- You must be a Member of Burnaby Neighbourhood House (BNH)/BCS and a Burnaby resident

We do not do: Income tax returns for individuals who:

- are self-employed

- have claimed bankruptcy

- are deceased

- have capital gains or losses – stock/mutual fund investments (no interest income over $1000)

- claim employment expenses

- have business or rental income and expenses

- have foreign income or assets (We can do foreign pensions and US Social Security income)

- are non-residents

This is a clinic is run by volunteers with limited knowledge or taxation and some experience in filing simple personal income tax returns.

All tax services are free of charge, but you must be a member of the BNH. Individual $5 or Family $10 (cash or cheque only). Tax receipts are issued for donations greater than $15

*Fee can be waived for those in financial need

What documents to bring to your appointment, and what information you have to know:

- A “government-issued” photo ID card for each adult member of the family Canadian Citizenship Card, PR Card, BC ID, BC Driver License, or BC CareCard.

- Social Insurance number for each filing adult family member.

- All income tax slips (T4, T4A, T-5007 etc) and your notice of assessment for last year. If you haven’t received all your tax forms for the year, please first get all your tax slips before booking an appointment

- Medical expense receipts (receipts for prescribed medication or treatments)

- Receipts for child care services, day camps and resident camps where the primary goal of the camp is to care for children

- All other receipts related to your income tax

- If you are renting, please bring the name of the landlord/company you pay rent to, number of months living at this address, and exact amount paid monthly

To file income tax returns for each member of the household who is required to file a tax return:

- Bring all tax slips, documents and receipts mentioned above

- All family members are encouraged to file together, as it would make it easier and lessens the amount of data needed to be entered. Appointments are 30 minutes for each file

- Families with dependents under 19 who have taxable income will need to bring their T4 slips

- Families claiming childcare expenses must have the receipts for payments. If the service was provided by an individual, they must have name, address and social insurance number of that individual

- Students who have paid tuition fees during the tax year will need to bring a copy of form T2202A – Tuition, Education, and Textbook Amounts Certificate

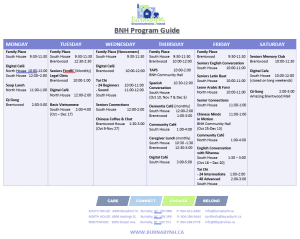

Income Tax Clinics Locations:

BNH South House

4460 Beresford Street, Burnaby, BC V5J 0B8

BNH North House

4908 Hastings Street, Burnaby, BC V5B 1P6

Tel: 604-294-5444

BNH Brentwood House

2055 Rosser Ave, Burnaby, BC V5C 0H1

(Rosser Ave. and Lougheed Hwy.)

Tel: 604-299-5778

Become a BNH Member Today!

Family membership $10/year

Individual membership $5/year